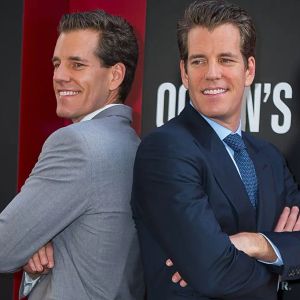

Tyler Winklevoss, co-founder of cryptocurrency exchange Gemini, has accused JPMorgan Chase, the largest bank in the United States, of unfair treatment. This accusation followed his criticism of the banking giant for charging fintech companies for access to customer banking data. In a recent post on X , Winklevoss said JPMorgan paused Gemini’s onboarding process right after he spoke out against the bank’s new policy. Tyler Winklevoss Says JPMorgan’s New Policy is Harmful The controversy began when a Bloomberg report revealed that JPMorgan plans to implement fees for fintech firms that require access to bank data for their services. This includes apps and services that help users buy crypto, manage finances, or use digital wallets. Winklevoss called this policy “anti-competitive” and warned that it could hurt innovation in fintech and cryptocurrency. Although JPMorgan has not yet publicly addressed the recent allegations, this situation has raised worries for the fintech and crypto sectors. They fear that new fees could make it harder for smaller companies to compete and may strengthen the hold of traditional banks. Notably, Winklevoss’s comments reflect a growing conflict between traditional banks and new financial technologies. As more people adopt crypto, partnerships between banks and crypto platforms have become essential. However, moves like JPMorgan’s could hinder this growth, particularly for platforms like Gemini that depend on easy banking connections. JPMorgan Discusses Blockchain’s Role in Capital Markets Meanwhile, JPMorgan has taken a proactive step in shaping digital asset regulation by meeting with the SEC’s Crypto Assets and Cyber Unit, also known as the Crypto Task Force. As reported by TheCoinRise, executives from JPMorgan and members of the crypto division discussed the broader implications of blockchain adoption in traditional markets. Topics included risk assessment, benefits of decentralization, and how firms like JPMorgan could position themselves competitively in a rapidly evolving financial landscape. The bank also highlighted its current presence in the crypto ecosystem. Its digital platform facilitates repurchase agreements, a critical segment of short-term lending under its “Digital Financing” and “Digital Debt Services” categories. Donald Trump Connection and Regulatory Shadows Recall that the cryptocurrency exchange has taken a significant step towards an Initial Public Offering (IPO). Gemini has filed a confidential draft registration statement with the United States Securities and Exchange Commission (SEC). Beyond its market ambitions, Gemini has also garnered political attention . The Winklevoss twins, prominent figures in both crypto and politics, each contributed $1 million to President Donald Trump’s campaign. Though political affiliations aren’t directly tied to the IPO, such connections add a layer of public scrutiny and regulatory sensitivity. The confidential filing structure may be a strategic move to minimize premature exposure and potential backlash. Nonetheless, the firm’s decision to move forward indicates growing optimism within the crypto sector. The post Gemini CEO Tyler Winklevoss Calls Out JPMorgan, Here’s Why appeared first on TheCoinrise.com .